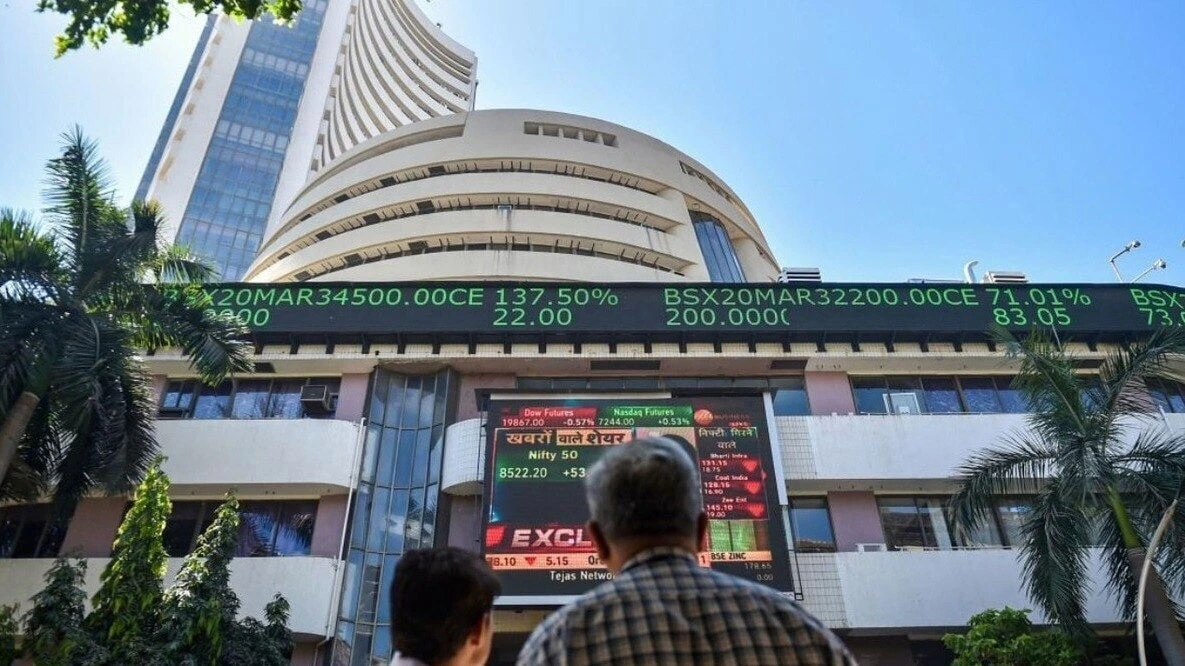

20 Nov 2024, 2: 05 PM A recent report by Jefferies has highlighted a significant trend in the investment preferences of Indian households. Despite the growing popularity of stock markets, equities still account for a small portion of household wealth in India.

According to the report, equities represent just 5.8% of the total assets of Indian households, far behind other investment avenues such as property, gold, and fixed deposits (FDs).

Dominance of Real Estate and Gold

Indian households have long favored property and gold as their primary forms of investment. Real estate, in particular, remains a preferred asset class, driven by the desire for physical assets and long-term capital appreciation.

This preference is rooted in cultural factors, with owning property often seen as a symbol of financial security and social status.

Gold also continues to play a significant role in the investment portfolios of Indian families. Gold is considered a safe haven asset, especially in times of economic uncertainty.

Its cultural and emotional appeal adds to its enduring popularity. Many households view gold not just as an investment but as a form of wealth preservation passed down through generations.

Fixed Deposits and Safe Investments

Fixed deposits (FDs) are another key asset category that Indian households gravitate towards.

The safety and guaranteed returns offered by FDs are major factors that attract investors. With a large portion of the population still prioritizing low-risk investment options, FDs remain a go-to choice for those who value security over high returns.

This trend is particularly noticeable among older generations, who often have conservative investment strategies.

The Slow Growth of Equity Investments

Despite the potential for higher returns, equities account for a relatively small share of Indian household assets.

This could be attributed to several factors, including a lack of financial literacy, market volatility, and traditional risk-averse tendencies.

Many Indian households still prefer tangible and more secure assets, leaving equities as a secondary investment option.

However, the report suggests that there is a growing shift towards equity investments, especially among younger and more financially savvy individuals.

The rise of digital trading platforms, financial education, and awareness campaigns have started to encourage more Indians to explore the stock market.

Conclusion

While equities have yet to overtake property, gold, and FDs in terms of household investment allocation, the trend is slowly changing.

As financial literacy improves and the younger generation embraces riskier yet rewarding investments, the share of equities in Indian households’ portfolios may increase in the coming years.

The Jefferies report sheds light on the deep-rooted investment preferences in India, indicating that a cultural shift towards financial diversification might be on the horizon.