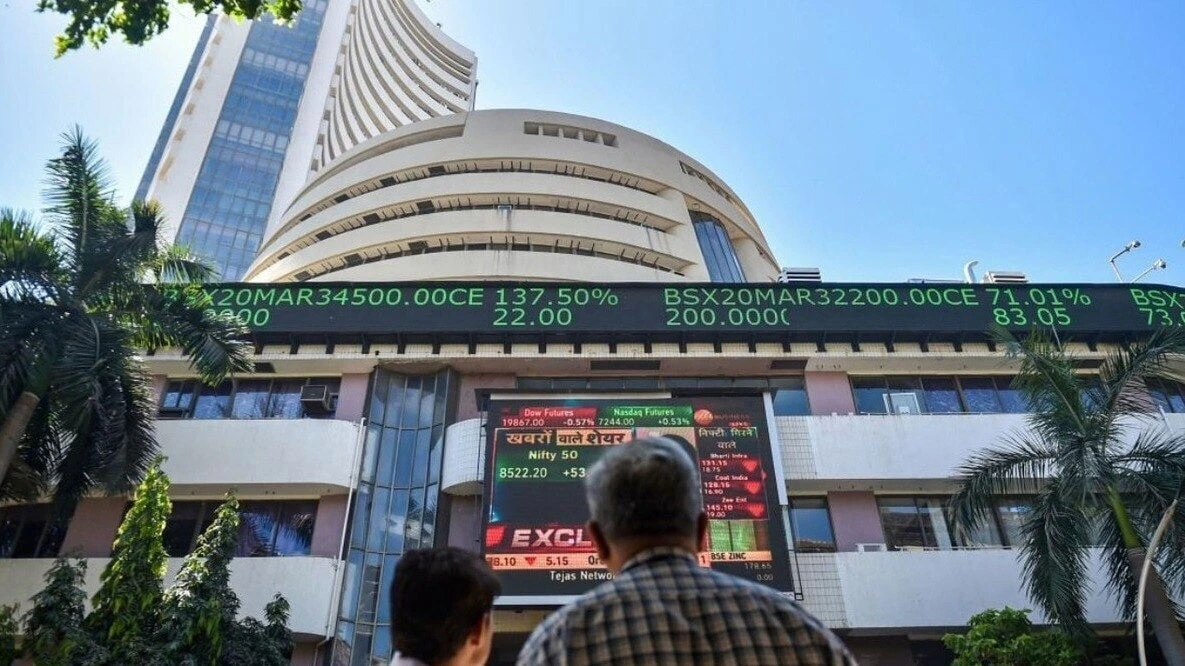

24- Sep 2024, 11:30 AM India’s stock markets have reached unprecedented heights, with both the Sensex and Nifty indices hitting record levels. Driven by Global Market Optimism, the Sensex surged past the significant 85,000 mark.

Meanwhile, the Nifty index followed suit by reaching an all-time high.

This upward momentum is largely attributed to favorable global economic conditions, robust corporate earnings, and strong foreign institutional investor (FII) inflows, marking a promising period for investors.

Global Market Optimism Boosts Indian Equities

The recent surge in India’s benchmark indices has been fueled by a wave of global market optimism.

As global economies stabilize and recover from the uncertainties caused by the pandemic and geopolitical tensions, investor confidence has soared.

Central banks across the globe are adopting more accommodative monetary policies, resulting in liquidity inflows in emerging markets, including India.

Indian equities have benefited from this trend, with foreign investors pouring funds into the stock market.

The rise in global risk appetite has made emerging markets, particularly India, an attractive destination for investment.

This influx of capital has been instrumental in pushing the Sensex and Nifty to new highs, reflecting the positive sentiment prevailing in global markets.

Strong Corporate Earnings Add to the Rally

In addition to global market optimism, strong domestic corporate earnings have played a pivotal role in boosting market sentiment.

Companies across various sectors have reported robust quarterly earnings, surpassing analysts’ expectations.

The strong performance of key sectors like IT, banking, energy, and pharmaceuticals has injected confidence into the market, further driving the rally.

Several blue-chip companies have posted significant profit growth, and this has resonated positively with investors.

The banking sector, in particular, has seen substantial gains due to improved asset quality and rising credit demand, contributing to the stock market’s impressive performance.

Economic Reforms and Investor Confidence

India’s structural reforms and economic initiatives have also contributed to the current market highs. The government’s focus on infrastructure development, ease of doing business, and fostering a robust startup ecosystem has attracted both domestic and foreign investors. The global market optimism has dovetailed with these reforms, enhancing India’s growth outlook.

Additionally, the Reserve Bank of India’s (RBI) consistent efforts to maintain a stable inflation rate and support economic growth have been well-received by market participants.

Low interest rates and pro-growth policies have encouraged businesses to expand, further boosting investor sentiment.

Outlook: Riding the Wave of Global Market Optimism

As Indian markets continue to benefit from global market optimism, analysts expect the upward momentum to persist in the near term.

However, they also caution that any shifts in global economic conditions, such as changes in central bank policies or geopolitical risks, could introduce volatility.

For now, India’s stock markets are riding high on a wave of optimism, with both the Sensex and Nifty showcasing the resilience of the Indian economy in a globally positive environment.