09-Jan-2025, 02:22 PM

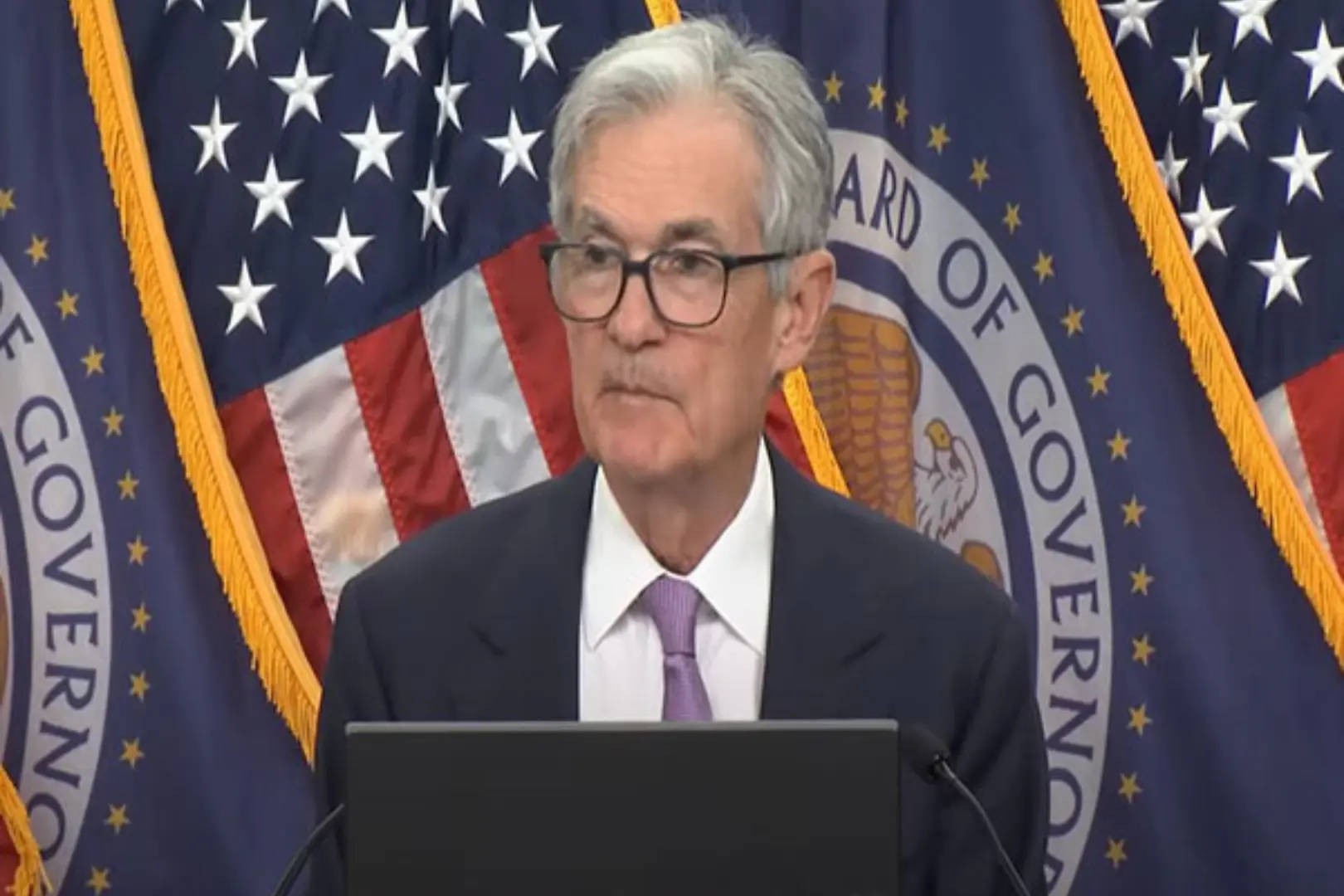

Minutes from the Federal Reserve’s December 17-18 meeting, released on January 8, 2025, reveal a cautious approach among officials regarding future interest rate cuts. While the Fed did lower rates by a quarter-point during that meeting, the discussions highlighted significant divisions among members about the appropriateness of further reductions, reflecting concerns over persistent inflation and economic uncertainties.

The decision to cut rates was not unanimous; Cleveland Fed President Beth Hammack was the sole dissenter, advocating for maintaining the current rate. The minutes indicated that many officials were apprehensive about moving too quickly to ease monetary policy, particularly given recent inflation data that remained above the Fed’s 2% target. “Nearly all participants assessed that the risks to the inflation outlook had increased,” the minutes stated, underscoring a growing consensus that a more measured approach was necessary moving forward.

Policymakers expressed their belief that they were “at or near the point at which it would be appropriate to slow the pace of policy easing.” This sentiment reflects a broader acknowledgment of the economic landscape’s volatility, particularly in light of potential trade and immigration policy changes anticipated under President-elect Donald Trump. Although Trump was not directly mentioned in the minutes, his proposed tariffs and deregulation plans were noted as sources of uncertainty that could impact inflation and economic growth.

As a result of these discussions, Fed officials revised their projections for interest rate cuts in 2025, reducing expectations from four cuts to just two. This shift indicates a significant change in strategy as they prioritize careful evaluation of incoming economic data before committing to further reductions. The minutes emphasized that the Fed is “well positioned to take time to evaluate the evolving outlook for economic activity and inflation,” suggesting a deliberate approach to monetary policy in the coming months.

Market reactions to the release of these minutes were muted, with investors largely anticipating that the Fed would maintain its current stance during its upcoming meeting at the end of January. The cautious tone adopted by Fed officials signals a shift in focus towards stabilizing inflationary pressures while balancing economic growth, marking a pivotal moment in U.S. monetary policy as it navigates an uncertain economic environment.