12-Jun-2024, Wed.

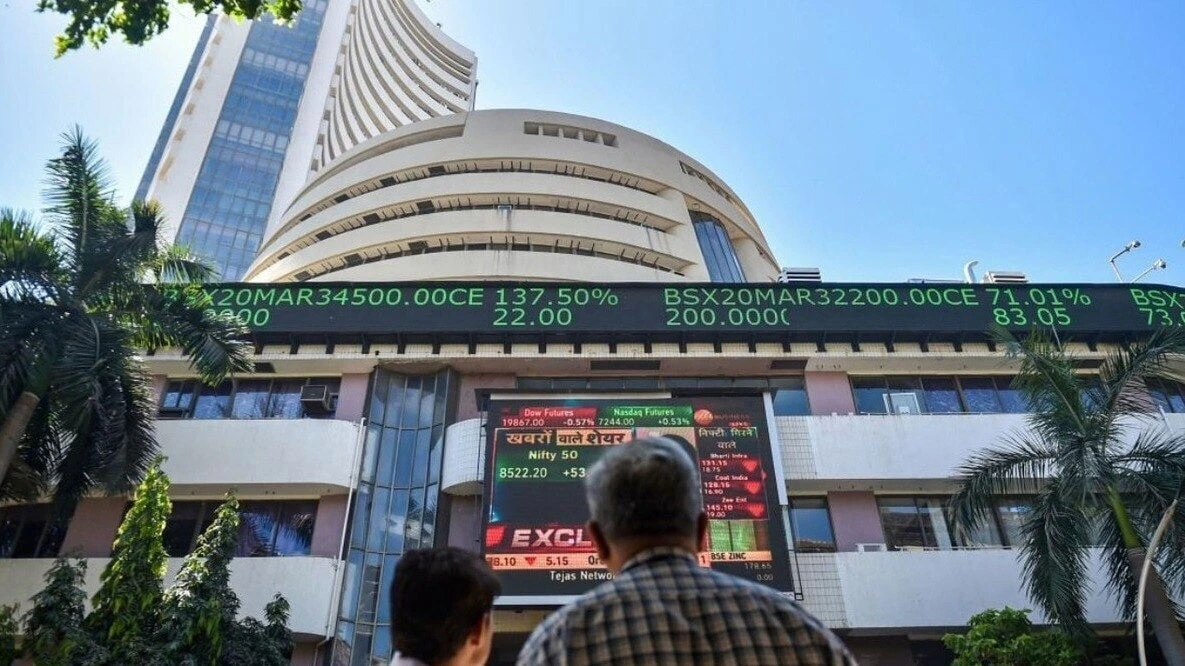

Prior to the announcement of May’s inflation statistics, Indian stocks moved strongly, with the Sensex and Nifty indices holding notable gains for a significant part of the trading day on Tuesday.

This was largely due to the anticipation of the inflation data and the US Federal Reserve meeting decision, which were expected to provide clues on possible rate cuts in 2024. The Indian Rupee had settled at a record closing low of 83.57 against the US dollar the previous day, tracking the rise in the Dollar index. The market participants were bracing for the May inflation numbers, factory output for the month of April, and the US Federal Reserve meeting decision, which were expected to guide the market action.

The data was released post market hours on Wednesday, with the annual retail inflation rate in India easing slightly to 4.83% in April from 4.85% in the previous month, an 11-month low. This was loosely in line with market estimates of 4.8%. The inflation rate remained within the RBI’s tolerance band of 2 percentage points from 4%, indicating that the central bank was likely to hold its key rate unchanged at the terminal level in upcoming decisions. The Indian stock market had been consolidating with a positive bias, sustaining above the upper band of its rising channel. The immediate support remained at 22,200, and if this level was breached, the index could slip towards the 23.6% Fibonacci retracement level situated at 21,900. A move above 23,350 would resume the uptrend.The Bank Nifty had formed a bearish candle with a small body, failing to surpass the 50,000 level but remaining above its short-term moving average.

There could be slight weakness if the index slipped below 49,600, which might lead to a test of the 49,300-49,100 levels. However, the primary trend remained strong as long as the 49,000 level was sustained. Overall, the Indian stock market was poised for a potentially volatile trading session as investors awaited the release of the May inflation statistics and the US Federal Reserve meeting decision.The market was expected to remain sensitive to the outcome of these events, which could influence the direction of the market in the coming days.